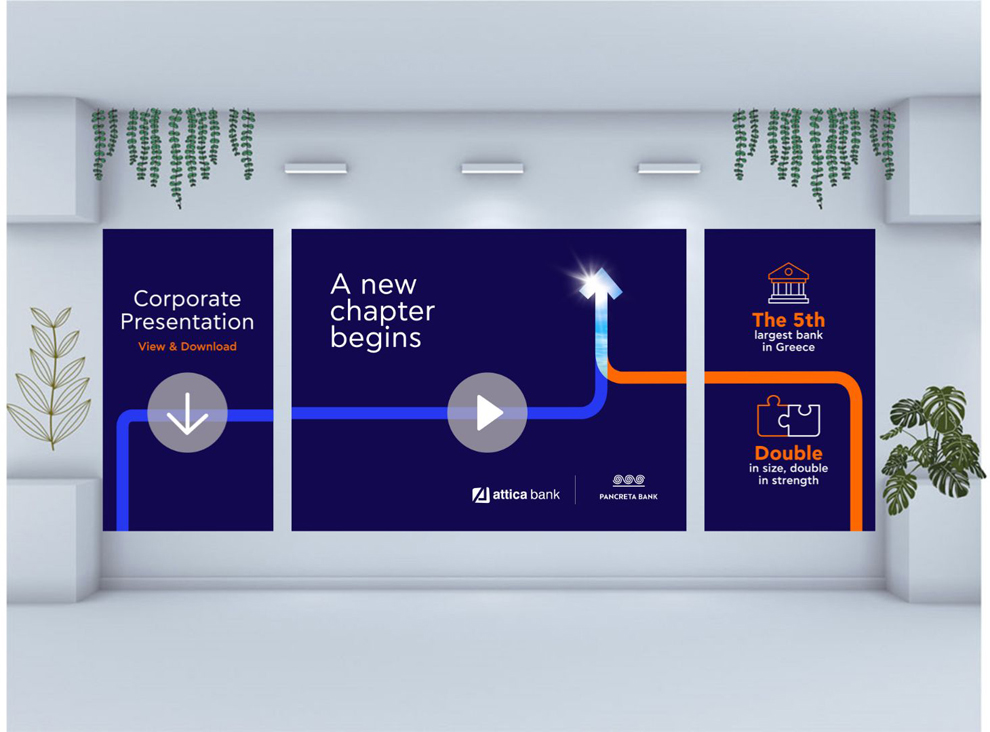

Attica Bank: A New Chapter Begins in Greek Banking

Attica Bank has entered a pivotal chapter in its history, reshaping the Greek banking landscape through its merger with Pancreta Bank. The new Bank is more than a solid financial entity; it reflects a shared commitment to inclusivity, resilience, and progress for Greece's economic future.

Transformation Through Unity

The merger establishes the new Attica Bank as the fifth-largest banking institution in Greece, consolidating forces of two historic entities with complementary strengths, that focus on addressing long-standing challenges and creating opportunities to deliver lasting value to shareholders and customers. By prioritizing resilience and adaptability, the bank is positioned to navigate an ever-changing financial landscape with confidence and purpose.

Empowering Customers and Communities

The bank's nationwide presence, with 75 branches, five business centers, and 130 ATMs, is complemented by a suite of innovative digital tools. These solutions ensure a seamless, secure, and user-friendly banking experience, empowering customers to manage efficiently their financial needs.

The bank prioritizes small and medium-sized enterprises (SMEs) and individual clients, aligning with its mission to foster local entrepreneurship and economic resilience. Through personalized services and adaptive solutions, the new Bank supports growth at every level of the economy.

Commitment to Sustainability and ESG Principles

At the core of the new Bank's vision is its adherence to ESG principles. This commitment leads to initiatives that promote social inclusion, environmental stewardship, and responsible governance. By embedding sustainability into its operations, the bank contributes to Greece's long-term prosperity and leads by example in the financial sector.

A Vision for Sustainable Growth

The bank's strategic roadmap is rooted in a commitment to sustainable profitability and dynamic expansion. Central to this vision is the goal of building a resilient institution capable of delivering long-term value for customers, shareholders, and the broader economy. By focusing on operational efficiency and innovative solutions, the bank is positioning itself as a reliable partner for businesses and individuals seeking financial stability and growth opportunities.

This approach underscores the importance of fostering trust and creating value through prudent management, strategic investments, and a customer-centric philosophy. The new Bank aspires to support the financial needs of its clients while driving positive economic and social impact, ensuring its role as a vital force in Greece's evolving financial ecosystem.

Redefining Banking in Greece

The new Attica Bank is more than a financial institution—it is a catalyst for change. By embracing transparency, accountability, and innovation, the bank is redefining banking standards in Greece. Its mission extends beyond financial services, aiming to build trust and contribute meaningfully to the communities it serves.